Overview

This award summary provides an overview of some of the key features of the Animal Care and Veterinary Services Award 2020 (MA000118).

This information is current as at December 2022. Awards are updated regularly and you should always refer to a current copy of the award for the most up to date information. A copy of the Animal Care and Veterinary Services Award 2020 is available here.

A pay guide summary for the Animal Care and Veterinary Services Award (MA000118) is available here. Pay rates are reviewed annually by the Fair Work Commission. This pay guide is effective from the first full pay period on or after 1 July 2022.

To keep across any changes to the Animal Care and Veterinary Services Award 2020 (MA000118), you can register here.

For advice specific to your organisation, please contact your Liquid HR representative, or contact us via enquiries@liquidhr.com.au or 1300 887 458.

Animal Care and Veterinary Services Award

Coverage

This award covers employers throughout Australia in private veterinary surgery practices and the animal care industry and their employees in the classifications listed below:

- animal care industry inspectors;

- Practice managers;

- Veterinary nurses;

- Receptionists;

- Animal attendants and Assistants; and

- Veterinary surgeons.

The animal care industry means community-based charity organisations working to prevent cruelty to animals by actively promoting their care and protection and educating people in the care of animals.

The Animal Care and Veterinary Services Award does not cover employers in the following industries:

(a) Amusement, Events and Recreation Award 2020;

(b) Food, Beverage and Tobacco Manufacturing Award 2020;

(c) Horse and Greyhound Training Award 2020; and

(d) Pastoral Award 2020.

Classification

- A description for each classification level is contained in Schedule A of the award.

- Employees must be advised in writing of their classification and of any changes to their classification.

- The employer must determine the employee’s classification based on the skill level that the employee requires to carry out the principal functions of their employment.

Types of employment

Employees can be engaged as:

- Full-time

- an average of 38 ordinary hours per week. The average must not exceed 152 hours in 28 days or an average of 38 hours over the period of an agreed roster cycle.

- Part-time

- performs less than 38 ordinary hours on a regular basis

- Casual

- A person is a casual employee if:

- An offer of employment is made on the basis that the employer makes no firm advance commitment to continuing and indefinite work according to an agreed pattern of work and the person accepts that offer.

- A casual employee will be paid by the hour with a 25% loading on the pay rate instead of paid leave entitlements such as sick leave and annual leave.

- Minimum number of hours they can be paid for is 3 hours’ work at the appropriate rate. This may be reduced to 2.5 hours if all of the following circumstances apply:

- the employee is a full-time secondary school student; and

- the employee is engaged to work between the hours of 3.00 pm and 7.00 pm on a day which they are required to attend school; and

- the employee agrees to work, and a parent or guardian of the employee agrees to allow the employee to work, a shorter period than 3 hours; and

- employment for a longer period than the period of the engagement is not possible either because of the operational requirements of the employer or the unavailability of the employee.

- A person is a casual employee if:

- Full-time

Offers and request for casual conversions

A casual employee has the right to request part time or full-time employment if employee has been employed for 12 months and during the last 6 months has worked a regular pattern of hours on an ongoing basis.

The offer by the employer must be in writing within 21 days after the end of their 12-month period. If the employee has worked the equivalent of full-time hours during that period, the offer must be for full time employment. If the employee has worked less than the equivalent of full time hours during that period, the offer must be part time employment.

The employee must give a response within 21 days of receipt of the offer stating whether they accept or decline. If the employee fails to provide a response by this time, the employee is taken to have declined the offer.

Hours of work

The maximum length of the ordinary hours for any one shift must not exceed 10 hours not including meal breaks.

Span of hours

Ordinary hours are between 6am – 9pm Monday to Sunday. The ordinary hours of work are to be worked continuously, except for meal breaks, at the discretion of the employer. The employer and an individual employee may agree to alter the span of hours.

Make up time: An employee may elect, with the consent of the employer, to work make-up time where the employee takes time off during ordinary hours and works those hours later during the spread of ordinary hours.

Veterinary surgeons:

(a) Time taken for travel required in the performance of duties ,except for active on-call duty, will contribute to hours of work. Required in the performance of duties includes travel additional to one return trip between the associate’s place of residence and the place of work in any one day and travel between different locations of a practice.

(b) Associates, other than casuals, should receive a minimum of 3 full days off per fortnight. Days off and time off instead will accumulate if not given. However, if these days are not used within 6 weeks, they must be paid out at the associate’s ordinary rate of pay.

Breaks

Unpaid meal breaks: An employee is entitled to an unpaid meal break of not less than 30 minutes between the fourth and fifth hour of work.

Paid rest breaks:

(a) Employees (other than associates) must receive, a paid rest break of 10 minutes after 4 hours work.

(b) E employee working 7.6 hours per day will be entitled to two 10-minute paid rest breaks.

(c) Where there is agreement, rest breaks can be combined into one 20-minute paid rest break.

(d) Rest breaks are to be counted as part of time worked.

Rosters

Veterinary surgeons: Daily work rosters will be published at least one month in advance. All annual holiday and public holiday rosters will be published at least 2 months in advance.

Consultation provisions are required where an employer proposes to change the regular roster or ordinary hours of work of an employee, other than an employee whose working hours are irregular, sporadic or unpredictable.

The employer must consult with any employees affected by the proposed change and their representatives (if any), including:

providing to the employees and representatives information about the proposed change (for example, information about the nature of the change and when it is to begin); and

invite the employees to give their views about the impact of the proposed change on them (including any impact on their family or caring responsibilities) and also invite their representative (if any) to give their views about that impact.

considering any views given by the employees and their representatives.

Minimum rates of pay

For rates of pay, refer to the Animal Care and Veterinary Services Award 2020 pay guide available here. Note, these rates are effective from 1 July 2022.

Higher Duties

Other than veterinary surgeons: An employee engaged for a day or shift on duties for which a higher rate than their ordinary classification must be paid the higher rate for that entire day or shift.

Veterinary surgeons: An associate who is required to perform duties at a higher classification level for a temporary period of more than 2 weeks must be paid the higher salary for the period during which those duties are performed.

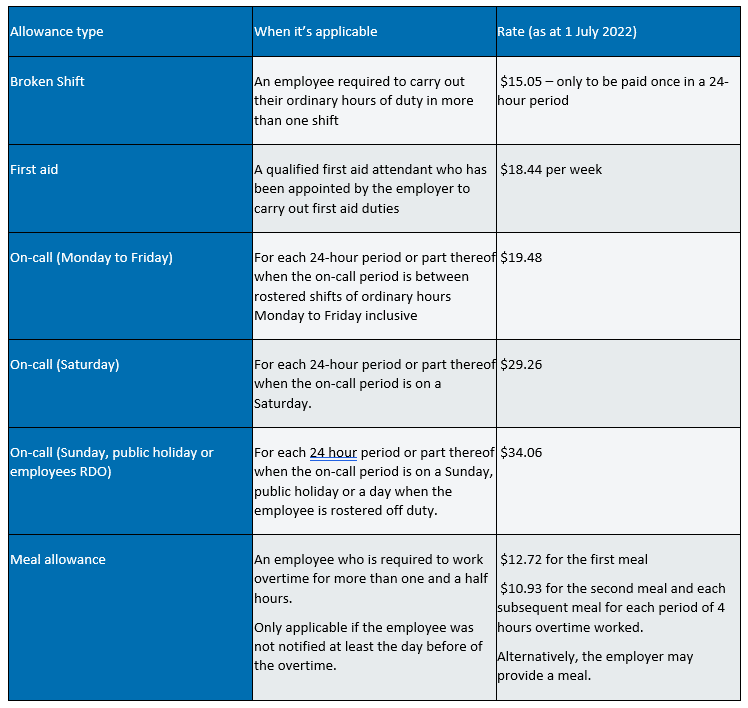

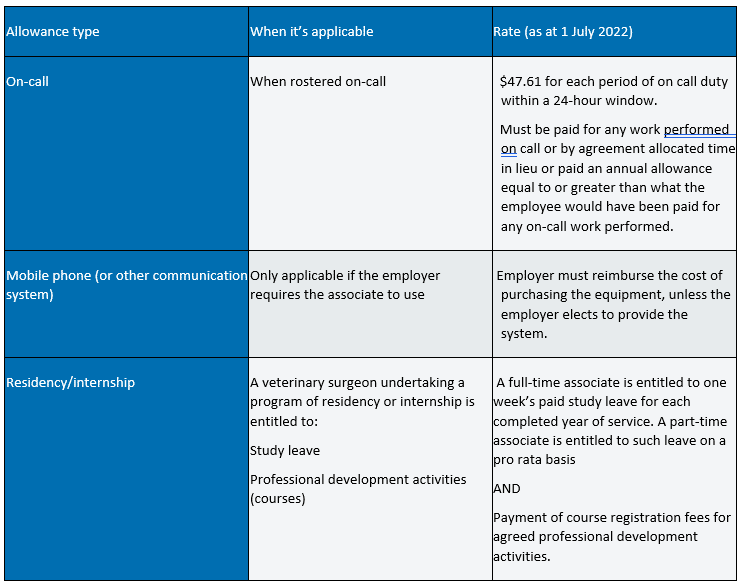

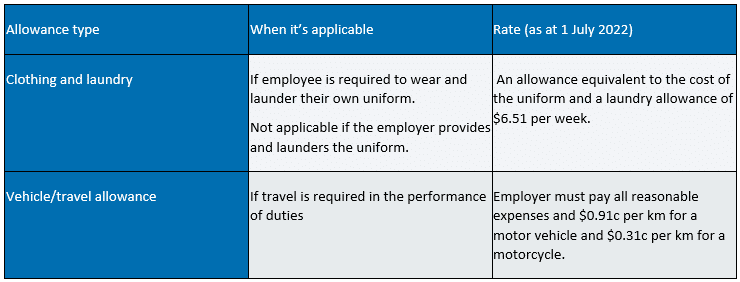

Allowances – other than veterinary surgeons

Allowances –veterinary surgeons

Allowances – applicable to all employees

Payment of wages

Associates must be paid at least monthly.

All other employees must be paid weekly or if the employee and employer agree fortnightly or monthly.

Overtime – other than veterinary surgeons

Overtime is applicable:

- for full time, part time and casual employees who perform work outside the ordinary hours (between 6am – 9pm Monday to Sunday)

- for employees engaged on shift work, for all work outside ordinary hours or in excess of 8 hours. Overtime rates are paid instead of shift work penalty rates.

- Where an employee is required to return to duty after the usual finishing hour of work for that day (must also be paid for a min of 3 hours work)

Refer to the pay guide available here for overtime rates.

An employee and employer may agree in writing to the employee taking time off instead of being paid for a particular amount of overtime that has been worked by the employee. An example agreement is contained in Schedule E of the award.

Overtime –veterinary surgeons

Employers will compensate associates for time worked in addition to 38 hours per week, either by:

(i) granting additional remuneration at the employee’s ordinary time rate; or

(ii) granting time off instead of payment on an hour for hour basis, if agreed by the associate.

(b) An allowance instead of some or all of the amounts otherwise payable may be paid where the associate and employer reach agreement. The allowance and any other payments for extra hours are not to be less than would otherwise have been payable calculated over a calendar year.

(c) Agreements must be recorded in writing.

Penalty rates – other than veterinary surgeons

Penalty rates are applicable for work performed:

- On a Saturday after 1pm

- Sundays

- Public holidays (min engagement of 4 hours)

Refer to the pay guide available here for the specific rates for each classification.

Note: Different rates apply to shiftworkers, defined as “a 7-day shiftworker who is regularly rostered to work on Sundays and public holidays in a business in which shifts are continuously rostered 24 hours a day for 7 days a week.”

Shiftworkers

An employee may be transferred to or from shiftwork on 14 days’ notice provided the employee has at least 10 hours off duty before commencing shiftwork.

If 14 days’ notice is not given the employee will be paid overtime rates for all work done outside previous ordinary working hours within 14 days of the time of notification of the change.

Annual leave

As per the National Employment Standards (NES).

Shiftworkers are entitled to an additional week annual leave. A shiftworker is a 7-day shiftworker who is regularly rostered to work on Sundays and public holidays in a business in which shifts are continuously rostered 24 hours a day for 7 days a week.

Annual leave loading

To be paid on any annual leave taken.

- Day work: Employees who would have worked on day work only had they not been on leave—5%or the relevant weekend penalty rates , whichever is the greater but not both.

- Shiftwork: Employees who would have worked on shiftwork had they not been on leave—a loading of 5%or the shift loading (including relevant weekend penalty rates) whichever is the greater, but not both.

Annual leave in advance

An employer and employee can mutually agree in writing for an employee to take annual leave before the entitlement has been accrued. The written agreement must include; what date the leave is to commence and the amount of leave taken in advance. The agreement must be signed by both parties and kept on record. An example agreement is available in Schedule F of the award

If on termination the employee’s entitlement has not accrued to the amount of annual leave that has been taken, the employer may deduct an equal amount that was paid to the employee for the period of leave taken in advance from any money due to the employee on termination.

Close down

An employee can require an employee to take annual leave as part of a close down, but must provide at least 4 weeks notice.

Cashing out of annual leave

An employee and employer may mutually agree in writing to cashing out an amount of accrued paid annual leave. The written agreement must be signed by both the employer and employee and must include; the date on which the payment is made and the amount of leave to be cashed out and paid to the employee. The payment:

- Must not result in the employee’s annual leave accrual balance being less than 4 weeks

- The maximum amount an employee can cash out is 2 weeks within any 12-month period

Excessive leave accruals

An excessive leave accrual is if an employee has accrued more than 8 weeks’ paid annual leave (or for a shift worker 10 weeks’ annual leave). If an employee has an excessive amount of leave accrued, the employer and employee can discuss ways to decrease or eliminate the excessive leave accrual.

If an employer has truly attempted to reach an agreement with an employee but is unable to do so (for example, because the employee refuses to confer), the employer may instruct the employee to take one or more periods of paid annual leave in writing. The below rules have to be followed:

- When all other paid annual leave agreements made by the employer and employee are considered, the employee’s remaining accrued entitlement to paid annual leave cannot be less than 6 weeks.

- Employees cannot be required to take less than one week of annual leave.

- The employer must not require the employee to take paid annual leave that begins less than 8 weeks or ends more than 12 months after the directive is provided.

Personal/carer’s leave and compassionate leave

As per the National Employment Standards (NES).

Casual employees are entitled to be not available for work or to leave work to care for a person who is sick and requires care and support or who requires care due to an emergency.

A casual employee is entitled to be absent for a maximum of 48 hours. Any leave in excess of the 48 hours is to be by agreement with the employer. The absence is unpaid for casual employees.

Parental leave

As per the National Employment Standards (NES).

Community service leave

As per the National Employment Standards (NES).

Unpaid family and domestic violence leave

As per the National Employment Standards (NES).

Note: from 1 February 2023 all employees (full time, part time and casual) will be entitled to 10 days of paid family and domestic violence leave per year. For employers with less than 15 employees, this entitlement will commence from 1 August 2023.

Public holidays – other than veterinary surgeons

As per the National Employment Standards (NES).

Work on a public holiday or a substituted day must be paid for at 250% of the minimum hourly rate with a minimum payment of 4 hours provided the employee is available to work 4 hours.

Public holidays – veterinary surgeons

As per the National Employment Standards (NES).

Work on a public holiday or a substituted day must be paid for at 200% of the minimum hourly rate.

Permanent full-time and part-time associates required to work on 25 December will receive the Saturday or Sunday rate (as appropriate) plus a loading of 50% (of the ordinary time rate) and be entitled to the benefit of a substitute day.

Associates who normally work on weekends will not be disadvantaged if a prescribed public holiday falls on a day when they would not be working. There are provisions that allow them to receive an alternative day off, an additional one day of annual leave or an additional day’s wages.

Consultation and Dispute Resolution

If an employer decides to make significant changes in production, program, organisation, structure or technology that are likely to have significant effects on employees, the employer must:

- give notice of the changes in writing to all employees who may be affected by them and their representatives (if any);

- discuss with affected employees and their representatives (if any) the introduction of the changes, there likely effect and measures to avoid or reduce the adverse effects of the changes; and

- commence discussions as soon as practicable after a definite decision has been made.

When a dispute arises about a matter under the award or in regard to the NES, the parties must follow the processes outlined in clause 30 of the award.

Termination of employment

The Animal Care and Veterinary Services Award contains more beneficial notice of termination provisions than the National Employment Standards. These are:

- Notice by the employer: one month; or 5 weeks if the employee is over 45 years old and has completed more than 5 years of continuous service with the employer at the end of the day the notice is given.

- Notice by the employee: An employee must give the employer at least one month’s notice of termination of employment. If an employee who is at least 18 years old does not give one month’s notice, then the employer may deduct from wages due to the employee under this award an amount that is no more than one week’s wages for the employee.

Note: Notice of termination does not apply to the following employees:

- An employee employed for a specified period of time, for a specified task or for the duration of a specified season;

- An employee whose employment is terminated because of serious misconduct;

- A casual employee;

- An employee (other than an apprentice) to whom a training arrangement applies and whose employment is for a specified period of time.

The employer must pay an employee no later than 7 days after the day on which the employee’s employment terminates:

- the employee’s wages under this award for any complete or incomplete pay period up to the end of the day of termination; and

- all other amounts that are due to the employee under this award and the NES.

Where an employer has given notice of termination to an employee, the employee must be allowed time off without loss of pay of up to one day for the purpose of seeking other employment.

Redundancy

Redundancy pay is provided for in the National Employment Standards and is based on the employees length of service with the employer.

About Us

Liquid HR is a leading HR consulting firm helping businesses of all sizes to navigate the complexities of human resource management, while providing tailored HR services based on their unique requirements, including HR Outsourcing, Recruitment and HR Advisory Services.

With offices in Melbourne, Sydney and Brisbane, we work with businesses across Australia.

For more information, please contact us on 1300 887 458 and speak with one of our HR Consultants.